UNDERSTANDING

THE CLOSING PROCESS IN MEXICO

CLOSING OVERVIEW BY JAVIER MAZOY

This outline has been prepared on the basis of a standard cash purchase transaction. Of course, there are things that can occur, and the timeline is always subject to the dates established for deposits and action.

While every effort made to close a transaction timely, the process is to the Mexican requirements for Purchase and Sale as well as the availability of the Trustee Bank, Foreign Affairs Ministry, Lawyers involved, the parties involved, the closing coordinator, the Notary, and others. Patience and understanding are requested if dates are delayed – the process has been simplified over the years, however, it is still a process without shortcuts.

Throughout the process and upon completion of the transaction, you can be absolutely certain that you and your investment will be protected.

DAY 1 – The Offer is Accepted!

- Seller executes the Offer to Acquire (‘Offer’), offer to purchase the property.

- Purchaser executes an Escrow Agreement with the ‘Escrow Agent’ and Escrow Company. Escrow Notification Seller and Purchaser copy of his/her US passport(s) and driver’s license(s) and now with Money Laundering Law it requires KYC forms, Privacy notices forms and others.

DAY 2-14 – The Due Diligence Period

- As normally indicated in the Offer, Purchaser will deposit the agreed upon Initial Deposit (usually

$5,000 to $10,000 USD), plus escrow fee into escrow within three (3) business days of acceptance (the latest date on Offer signature line). - Purchaser’s Realtor will submit the fully accepted offer, escrow notification letter, Purchaser and

Seller’s IDs and all Seller’s ownership documentation to the Closing Officer and or Closing Company. - Closing Officer and or Closing Company will contact Purchaser upon notification that the Initial Deposit has been received, provide a closing costs estimation and additional settlement requirements and closing information and will work with Purchaser and/or Purchaser’s legal or fiscal counsel to determine how Purchaser will take title of the property, as well as work through all due diligence requirements and conditions established within the Offer.

- The Realtor will work with both Parties, including Closing Company and/or Lawyers and/or Closing Officer, Seller and Buyer to remove any contingencies, finalize inspections or inventories, etc., to remove all conditions that would delay the Earnest Money Deposit.

- Should Purchaser continue to be committed to the purchase of the property, Realtor will then, through their corresponding broker or officer, provide the wire and escrow agreement to Purchaser for the Earnest Money Deposit (EM).

- Should Purchaser decide not to move forward, the Realtor must facilitate the refund of the Initial

Deposit and advise Seller and the transaction will be canceled.

DAY 15 – The Earnest Money Deposit / End of Due Diligence Period

- Purchaser executes the Escrow Agreement, a standardized agreement with Escrow Company.

- Purchaser funds the Earnest Money Deposit, as indicated in the Offer. This deposit should be the full Earnest Money Deposit, less the Initial Deposit; for example – if the EM is 100,000 USD and the Initial Deposit was 10,000 USD, the balance due is $90,000 USD (unless otherwise indicated in the Offer).

- Purchaser additionally deposits the PRE-Closing Costs Fee (between $3,000 and $6,000 USD – Some companies request up to 50%). This fee will be applied to the closing costs due at closing and will offset the costs of pre-closing permits and requirements.

- Should Purchaser not deposit the Earnest Money Deposit, Broker will provide notification to the Realtor(s), Escrow Agent, Purchaser and Seller, and Purchaser shall have days to “cure” (deposit). If the deposit is not received within the five (5) days and no extensions have been negotiated, the transaction will be canceled with no further responsibility to Purchaser or Seller and the Initial Deposit shall be returned to Purchaser by Escrow Agent.

DAY 16 – 60 – Transfer of Title

- Purchaser and Seller all pending documentation to the Closing Company, Closing Officer and/or Notary, to complete the Transaction File to be submitted to the Notary and Trustee Bank. This will include all information to follow this timeline.

- Closing Officer and/or Closing Company and/or Law Firm in charge of closing will provide the Notary and Trustee Bank with the Transaction File with all requirements to the Notary, who in process of the transaction. The Associate Attorney and the Notary will be available to answer questions to Purchaser, Seller or their respective counsel at any time.

- The Notary will prepare a Capital Gain Tax estimation for the Seller’s Review (this is normally done now prior to OFFER ACCEPTANCE). Taxes are calculated value of both the Seller’s purchase (cost basis) and the sale price of the property based on the estimated peso value of the USD value at closing (Capital Gain tax or ISR for 2019 is 35% of the profit or gain in pesos).

- The Notary’s office will prepare the Trustee Bank Instruction Letters to be signed by both Purchaser and Seller. These letters are the Parties’ notification to the Trustee Bank that the property has been sold, the terms of the sale and acquisition, the appointment of the Notary as the official overseeing the sale, and also provides a proxy to one of the Associate Attorneys in the Notary’s office to sign the deed of title on behalf of Purchaser and Seller at closing, so neither Purchaser or Seller need be present. This letter will be submitted to the Parties’ with instructions on how to have the document accordance with Mexican Law, including apostilles, notary in the US, Consular Certifications, Translations, and others.

- Instructions by both Seller and Purchaser, or before, the Notary and/or Closing Company, or Law firm, will request the Foreign Affairs Permit (FAM or SRE Permit) from the Ministry of Foreign Affairs – a requirement for any foreigner purchasing in Mexico.

- The Notary will prepare the Deed of Title held in Trust (‘Trust Deed’) for the Trustee Bank’s

review, as the parties. The Trust Deed also called a Fideicomiso, is the ownership mechanism for foreigners (non-Mexican citizens) in Los Cabos, as well as all coastal and border areas of Mexico. The appointment of the Trustee is generally determined by the Notary and will often be the same Trustee as the Seller for reasons of cost and continuity. The Trustee’s only responsibility is to hold the Trust Deed on behalf of the Beneficiary Owner(s) and to act in accordance with their instructions. Property held in trust is not considered an asset of the Trustee Bank in accordance with the Mexican Constitutional Law. Also if there is an existing Trust then an assignment of Beneficiary Rights can be prepared. If the Purchaser is Mexican then the cancellation of the Trust and if both are Mexican is a Deed Transfer. - and acceptance of the Trust Deed, as well as closing documentation requirements (see attached list), the Trustee will authorize the Notary to execute the Trust Deed with the Parties’ or their authorized Proxy(s).

Day 60 – 65 – Settlement and Closing

- Upon the Notary’s receipt of the Trustee Bank’s letter of instruction and authorization to close on behalf of the Parties, the Notary will prepare his notification to Purchaser to fund escrow within five (5) days of the established closing date or as soon as possible.

- Closing Officer, and/or Closing Company and/or Law Firm, will prepare a draft settlement for Purchaser and Seller’s review, as well as the final wire instructions for Purchaser’s final deposit to Escrow.

- Purchaser and Seller authorize and sign the final Settlement Statement, which will be provided to the Escrow Agent.

- Purchaser funds Escrow with the balance of the Purchase Price, balance of Closing Costs and any additional fees assessed or negotiated.

- Upon receipt confirmation from the Escrow Agent that escrow has been funded in accordance with the Offer and Settlement Statement, the complete all necessary documentation for Transfer of Title and obtain the signatures required from the Trustee Bank as well as Purchaser and Seller or their respective Proxy(s).

- The Notary will submit to the Escrow Agent the following documents: a copy of the executed Trust Deed in favor of the Purchaser, Certificates of No Liens and No Tax Debt, a Preventive Notice of Sale filed in the Public Registry in favor of the Purchaser and a letter of confirmation that title has been duly transferred by Seller to Purchaser in accordance with Mexican Law.

- Escrow Agent will review all documents received by the Notary, verifying all conditions in the escrow agreement for the release of funds and within two (2) business days will release all funds in accordance with the Escrow Agreement and the Settlement Statement executed by Purchaser and Seller.

- This transaction has been successfully closed.

AFTER CLOSING – Where is my Trust Deed?

- During the immediate weeks following the transfer of title, the Notary will take the necessary steps to register the updated Trust Deed with the Municipal Tax and Public Registry Offices, as well as pay all requisite sale and acquisition taxes for both Purchaser and Seller.

- Within 10-14 days, upon payment of the Purchaser’s acquisition tax, the Notary will issue a simple (non-certified and non-registered) copy of the Trust Deed, to the Purchaser and their representative(s) to assist in transferring utility contracts, finalizing club memberships, etc.

- Approximately 3-4 months after closing, and upon recordation of the Trust Deed in the Public Registry, the Notary will issue the final closing package which will include; A certified original Deed of Trust in favor of the Purchaser, a certified English translation of the Deed of Trust, a summary of all Property and Deed information, a final closing statement and all receipts for closing expenses, fees and taxes paid, as well as a closing Escrow ledger to reconcile the deposits. All documents will be submitted both in paper and digital formats to the Closing Officer who will forward it to or hold for Purchaser as requested.

- Simultaneously the Notary will provide Seller with a copy of all fees and taxes (ISR) paid on his/her behalf for credit in the US or Canada (or another treaty compliant country) for taxes paid on foreign income earned.

WHAT DOCUMENTS WILL BE PROVIDED AFTER CLOSING?

FINAL CLOSING PACKAGE delivered to Purchaser:

- Certified copy of registered Trust Deed

- Certified translation of registered Trust Deed

- Trust Deed Summary form, itemizing the most important facets of the Trust Deed itself (Legal

- Description, Owner of Record, Registered Value, Tax ID Number, etc.)

- Final Settlement Statement & Escrow Disbursement Ledger and any applicable refund

- All closing expense receipts including acquisition tax, bank fees, Notary’s fees., etc.

- Copies of all prorated expenses paid, including property tax, HOA fees, etc.

- Title Insurance Policy – if purchased

FINAL CLOSING PACKAGE delivered to Seller:

- Certified Letter of Payment of Capital Gain Tax (ISR) or exemption as applicable from Notary

- Copy of Receipt of Payment of Capital Gain Tax (ISR)

- Copy of Receipt of Payment of any other affiliated expenses

- Final Settlement Statement

WHAT INFORMATION DO I NEED TO PROVIDE TO BUY OR SELL MY PROPERTY?

INFORMATION AND DOCUMENT REQUIREMENTS

Despite being held in trust by a Mexican authorized Trustee Bank, title can be held by Owner in nearly any manner accepted in the US; as an individual(s) in joint or separate tenancy, in an estate trust(s), in an LLC or incorporated entity, in a partnership agreement or in any combination thereof.

The requirements to complete the requisite file for the Notary, Trustee Bank, and the Foreign Affairs Ministry, however, are extensive. to companies, in particular, confusion as compliance to it’s on foreign entities. Current Money Laundry Law requires even more.

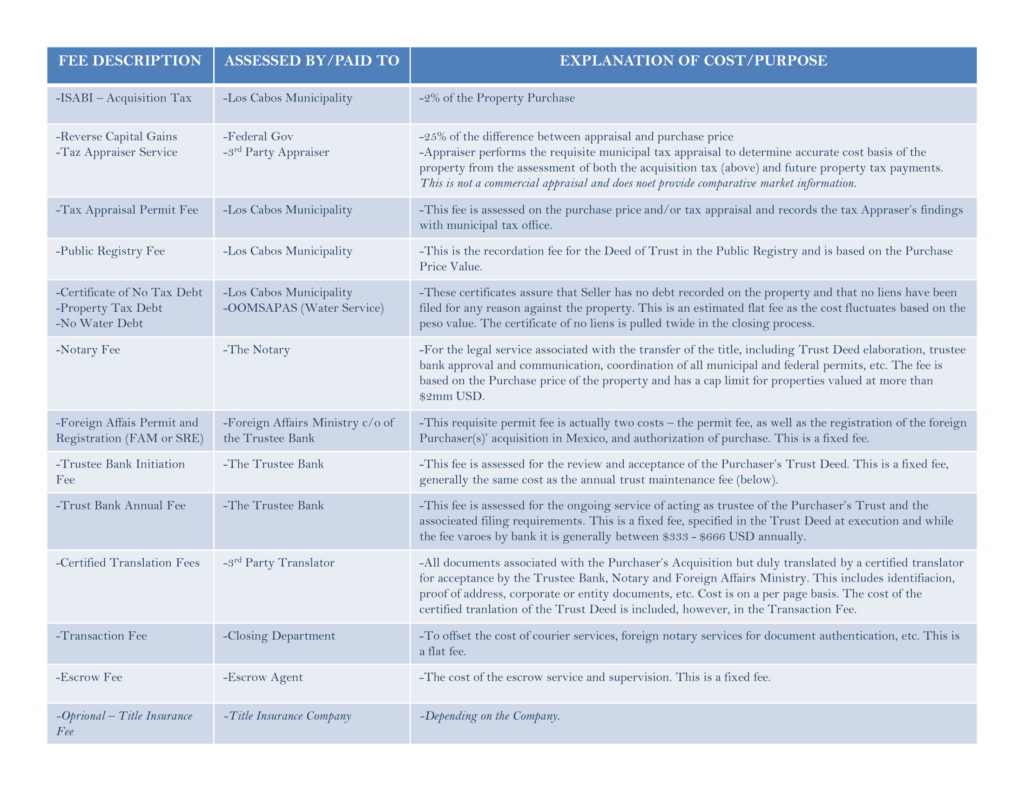

CLOSING COSTS IN MEXICO

EXPLANATION OF CLOSING COSTS IN MEXICO:

Closing costs in Mexico are quite different than most of our US or Canadian Purchasers are accustomed to. Outlined below is a simple explanation of the fees associated with a cash transaction (no- financing associated with the Property).

Closing costs are always assessed to the Purchaser and unlike in the US or Canada, are not negotiated for payment by the Seller. All Closing fees paid in Mexico (with exception to title insurance and extraneous legal fees) are added to the Purchaser’s complete acquisition cost for cost basis. All taxes and fees are calculated over the peso value of the price of the property regardless of currency transacted at purchase. Any fees provided prior to closing, and until the date of payment, are subject entirely to the peso exchange rates on the date of payment and/or exchange of currencies.

What closing fees does the Seller Pay?

At settlement, Seller is responsible for:

- Payment of all debt associated with the Property

- Capital Gain Tax (ISR) and Filing Fees

- Seller’s legal fees

- Realtor’s sales commissions

- Prorated fees assessed for property tax, homeowner’s associations and utilities if applicable (these items may be a credit to Seller-paid in full at closing).

How are Seller’s Capital Gain Calculated?

The Notary will calculate the Seller’s capital gain tax based on Seller’s purchase price, in Mexican Pesos, at acquisition. This information is indicated in the deed of title.

To the Seller’s original purchase price, the Notary adds to the value, the cost of any construction or remodel facturas, as well as the closing costs that the Seller paid at acquisition. After applying annual inflationary credit and construction depreciation factors, the resultant cost basis is determined.

The Notary then determines the capital gain tax (ISR) by subtracting the cost basis, as well as the sales commission from the sale price, to obtain the ‘gain’, which is taxed at 35%.

“Understanding the closing process in Mexico” was reproduced, with permission by Francisco Javier Mazoy Cámara – Founding Partner of LEX ADVISORS – Lawyer / Notary, Appraiser, Mediator, and Arbitrator.